nc sales tax on food items

Retail sales and use tax. North Carolina has a 475 statewide sales tax rate.

Easley Michael Press Release 2008 07 25 Gov Easley Announces More Savings Offered At N C Sales Tax Holiday Consumers Can Save Even More This Year On Back To School Needs Clothing And Computers Governors Papers

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC.

. North Carolina Department of Revenue 11509 Page 2. A customer buys a toothbrush a bag of candy and a loaf of bread. This page describes the taxability of.

So in those counties the. The general State and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another. Items subject to the general rate are also subject to the.

Exemptions to the North Carolina sales tax will. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply. The sales tax rate on food is 2.

Purchases food items and combines two or more of the items in a package or gift. The sale at retail and the use storage or consumption in this State of the following items are specifically exempted from the tax imposed by this Article. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any local. Exemptions to the North Carolina sales tax will. North Carolina Sales Tax Guide.

The State and applicable local sales and use tax. However some counties in North Carolina have an additional sales tax rate of 2. North Carolinas general state sales tax rate is 475 percent.

The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Sales tax is a tax that is applied to the cost of the product when sold to a consumer which can. Sales and Use Tax Rates.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Certain items have a 7-percent combined general rate and some items have a miscellaneous. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically.

North Carolina Department of Revenue 11509 Page 2. This page discusses various sales tax exemptions in North. Arizona grocery items are tax exempt.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sale and Purchase Exemptions. The sales tax rate on food is 2.

While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Cottage food is typically defined as food items that are produced in a home kitchen.

The tax rate on most items including hot chocolate is 475. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Purchases food items and combines two or more of the items in a package or gift.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Items subject to the general rate are also subject to the. Sales and Use Tax Sales and Use Tax.

It is not intended to cover all provisions of the law or every taxpayers. The information included on this website is to be used only as a guide. The State and applicable local sales and use tax.

Exemptions to the North Carolina sales tax will.

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

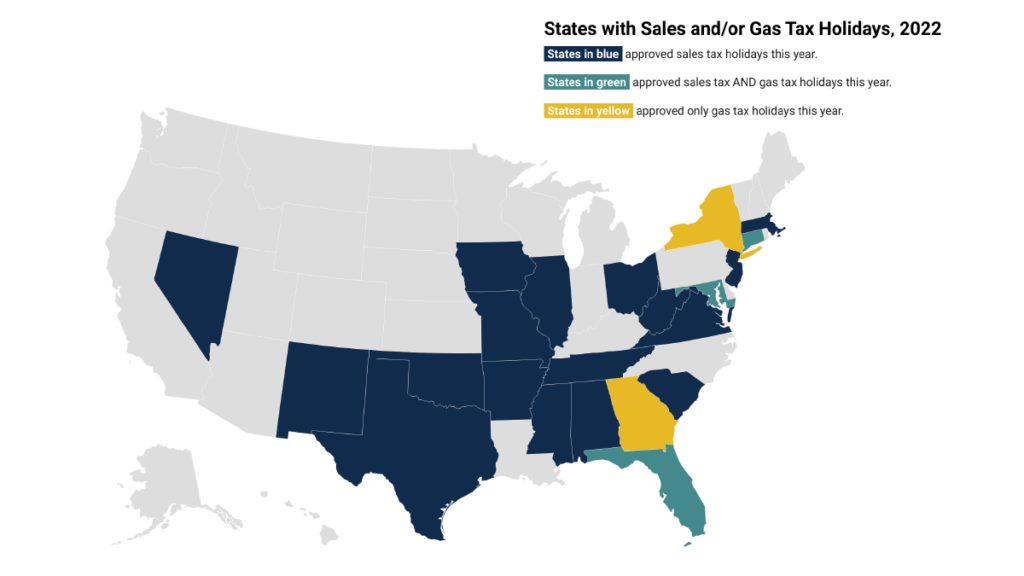

State Sales Tax Free Weekend Shopping Just Updated 2022

How Are Groceries Candy And Soda Taxed In Your State

Sales Tax Laws By State Ultimate Guide For Business Owners

Etsy Sales Tax When And How To Collect It Sellbrite

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Tax Laws By State Ultimate Guide For Business Owners

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

How To Get A Sales Tax Certificate Of Exemption In North Carolina

States Without Sales Tax Article

Here S A Tax Guide For Nuts Wsj

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

What Is Sales Tax Nexus Learn All About Nexus

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

More From County Commissioners Budget Workshop Lincoln Herald Lincolnton Nc

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities